Unlock a world of possibilities! Login now and discover the exclusive benefits awaiting you.

- Qlik Community

- :

- Forums

- :

- Analytics

- :

- App Development

- :

- Running Totals using Peek

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Running Totals using Peek

Hi All,

I have the following Data

| Id | Date | Balance | Projected Revenue |

| 1 | 1/1/2022 | 82,500,000.00 | - |

| 1 | 2/1/2022 | 72,187,500.00 | - |

| 1 | 3/1/2022 | 62,875,000.01 | 1,000,000.00 |

| 1 | 4/1/2022 | 51,562,500.01 | - |

| 1 | 5/1/2022 | 41,250,000.02 | - |

| 1 | 6/1/2022 | 30,937,500.02 | - |

| 1 | 7/1/2022 | 20,625,000.09 | - |

| 1 | 8/1/2022 | 10,312,501.37 | - |

And I want to create two new columns.

1. Projected Balance and 2. Factor

1. Projected Balance will be Balance + Projected Revenue but should include any previous projected Revenue.

ex. Projected Balance for all dates prior to 3/1/2022 will equal Balance while Projected Balance for all dates including and after 3/1/2022 will equal Balance + 1000000

2. Factor for all dates including and after 3/1/2022 will equal 1 plus Projected Revenue on 3/1/2022 divided by Balance on 3/1/2022

1 + (1000000/62,875,000.01)

My final table should look like this

| Id | Date | Balance | Projected Revenue | Projected Revenue | Factor |

| 1 | 1/1/2022 | 82,500,000.00 | 82,500,000.00 | 1 | |

| 1 | 2/1/2022 | 72,187,500.00 | 72,187,500.00 | 1 | |

| 1 | 3/1/2022 | 62,875,000.01 | 1,000,000.00 | 63,875,000.01 | 0.015905 |

| 1 | 4/1/2022 | 51,562,500.01 | 52,562,500.01 | 0.015905 | |

| 1 | 5/1/2022 | 41,250,000.02 | 42,250,000.02 | 0.015905 | |

| 1 | 6/1/2022 | 30,937,500.02 | 31,937,500.02 | 0.015905 | |

| 1 | 7/1/2022 | 20,625,000.09 | 21,625,000.09 | 0.015905 | |

| 1 | 8/1/2022 | 10,312,501.37 | 11,312,501.37 | 0.015905 |

I've managed to create Projected Balance using the below but am struggling with the Factor calculation. Additionally was wondering if there is a way to do this in just one load without the preceding load to improve run time when moved to a larger data set.

Set NullInterpret = '';

Table:

Load * Inline [

Id,Date,Balance,Projected Revenue

1,1/1/2022,82500000.00,

1,2/1/2022,72187500.00,

1,3/1/2022,62875000.01,1000000.00

1,4/1/2022,51562500.01,

1,5/1/2022,41250000.02,

1,6/1/2022,30937500.02,

1,7/1/2022,20625000.09,

1,8/1/2022,10312501.37,

];

Table1:

Load *,

If([Id] = Previous([Id]),RangeSum(Balance,[Running Projected Revenue]),Balance) as [Projected Balance]

;

Load

Id,

Date,

Balance,

[Projected Revenue],

If(Id = Previous(Id),RangeSum([Projected Revenue],Peek([Running Projected Revenue])),RangeSum([Projected Revenue])) as [Running Projected Revenue]

Resident Table;

Drop Table Table;

Exit script

Thanks!

Mark

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Try this

SET NullInterpret = '';

Table:

LOAD * INLINE [

Id, Date, Balance, Projected Revenue

1, 1/1/2022, 82500000.00

1, 2/1/2022, 72187500.00

1, 3/1/2022, 62875000.01, 1000000.00

1, 4/1/2022, 51562500.01

1, 5/1/2022, 41250000.02

1, 6/1/2022, 30937500.02

1, 7/1/2022, 20625000.09

1, 8/1/2022, 10312501.37

];

Table1:

LOAD Id,

Date,

Balance,

[Projected Revenue],

If(Id = Previous(Id), RangeSum([Projected Revenue], Peek('Running Projected Revenue')), RangeSum([Projected Revenue])) as [Running Projected Revenue],

If(Id = Previous(Id), RangeSum(Balance, [Projected Revenue], Peek('Running Projected Revenue')), RangeSum(Balance, [Projected Revenue])) as [Projected Balance],

If(Id = Previous(Id), If(Len(Trim([Projected Revenue])) = 0, Peek('Factor'), [Projected Revenue]/Balance), If(Len(Trim([Projected Revenue])) = 0, 1, [Projected Revenue]/Balance)) as Factor

Resident Table

Order By Id, Date;

DROP Table Table;- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Try this

SET NullInterpret = '';

Table:

LOAD * INLINE [

Date, Balance Original, Principal, Projected Funding Amount

9/1/2021, 123750000.00, , 0.00

10/1/2021, 113437500.00, 10312500.00, 0.00

11/1/2021, 103125000.01, 10312499.99, 0.00

12/1/2021, 92812499.99, 10312500.01, 0.00

1/1/2022, 82500000.00, 10312499.99, 0.00

2/1/2022, 72187500.00, 10312500.00, 0.00

3/1/2022, 61875000.01, 10312500.00, 1000000.00

4/1/2022, 51562500.01, 10312499.99, 0.00

5/1/2022, 41250000.02, 10312499.99, 0.00

6/1/2022, 30937500.02, 10312500.01, 2000000.00

7/1/2022, 20625000.09, 10312499.92, 0.00

8/1/2022, 10312501.37, 10312498.73, 0.00

8/2/2022, , 10312501.37, 0.00

];

Table1:

LOAD Date,

[Balance Original],

Principal,

[Projected Funding Amount],

If(Len(Trim(Peek('Running Projected Funding Amount'))) = 0, 1,

If([Projected Funding Amount] = 0, Peek('Running Projected Funding Amount'), (1 + ([Projected Funding Amount]/Peek('Updated Balance')))*Peek('Running Projected Funding Amount'))) as [Running Projected Funding Amount],

Principal *

If(Len(Trim(Peek('Running Projected Funding Amount'))) = 0, 1,

If([Projected Funding Amount] = 0, Peek('Running Projected Funding Amount'), (1 + ([Projected Funding Amount]/Peek('Updated Balance')))*Peek('Running Projected Funding Amount'))) as [Updated Principal],

RangeSum(Alt(Peek('Updated Balance'), [Balance Original]), [Projected Funding Amount],

-(Principal *

If(Len(Trim(Peek('Running Projected Funding Amount'))) = 0, 1,

If([Projected Funding Amount] = 0, Peek('Running Projected Funding Amount'), (1 + ([Projected Funding Amount]/Peek('Updated Balance')))*Peek('Running Projected Funding Amount'))))) as [Updated Balance]

Resident Table

Order By Date;

DROP Table Table;

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Try this

SET NullInterpret = '';

Table:

LOAD * INLINE [

Id, Date, Balance, Projected Revenue

1, 1/1/2022, 82500000.00

1, 2/1/2022, 72187500.00

1, 3/1/2022, 62875000.01, 1000000.00

1, 4/1/2022, 51562500.01

1, 5/1/2022, 41250000.02

1, 6/1/2022, 30937500.02

1, 7/1/2022, 20625000.09

1, 8/1/2022, 10312501.37

];

Table1:

LOAD Id,

Date,

Balance,

[Projected Revenue],

If(Id = Previous(Id), RangeSum([Projected Revenue], Peek('Running Projected Revenue')), RangeSum([Projected Revenue])) as [Running Projected Revenue],

If(Id = Previous(Id), RangeSum(Balance, [Projected Revenue], Peek('Running Projected Revenue')), RangeSum(Balance, [Projected Revenue])) as [Projected Balance],

If(Id = Previous(Id), If(Len(Trim([Projected Revenue])) = 0, Peek('Factor'), [Projected Revenue]/Balance), If(Len(Trim([Projected Revenue])) = 0, 1, [Projected Revenue]/Balance)) as Factor

Resident Table

Order By Id, Date;

DROP Table Table;- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Perfect thanks

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi @sunny_talwar ,

My data/ need has changed slightly was wondering if you'd be able to help. I have the below Data where

Balance Original = Prior Balance - Principal

| Date | Balance Original | Principal | Projected Funding Amount |

| 9/1/2021 12:00:00 AM | 123,750,000.00 | - | 0 |

| 10/1/2021 12:00:00 AM | 113,437,500.00 | 10,312,500.00 | 0 |

| 11/1/2021 12:00:00 AM | 103,125,000.01 | 10,312,499.99 | 0 |

| 12/1/2021 12:00:00 AM | 92,812,499.99 | 10,312,500.01 | 0 |

| 1/1/2022 12:00:00 AM | 82,500,000.00 | 10,312,499.99 | 0 |

| 2/1/2022 12:00:00 AM | 72,187,500.00 | 10,312,500.00 | 0 |

| 3/1/2022 12:00:00 AM | 61,875,000.01 | 10,312,500.00 | 1,000,000.00 |

| 4/1/2022 12:00:00 AM | 51,562,500.01 | 10,312,499.99 | 0 |

| 5/1/2022 12:00:00 AM | 41,250,000.02 | 10,312,499.99 | 0 |

| 6/1/2022 12:00:00 AM | 30,937,500.02 | 10,312,500.01 | 2,000,000.00 |

| 7/1/2022 12:00:00 AM | 20,625,000.09 | 10,312,499.92 | 0 |

| 8/1/2022 12:00:00 AM | 10,312,501.37 | 10,312,498.73 | 0 |

| 8/2/2022 12:00:00 AM | - | 10,312,501.37 | 0 |

I need to create new columns for "Updated Principal" and "Updated Balance" and "Growth Factor".

Updated Principal will equal

Principal * (1+(Projected Funding Amount/ Prior Updated Balance)

and my Updated Balance will equal

Prior Balance + Projected Funding Amount - Updated Principal.

Growth Factor will equal

(1 + (Projected Funding Amount / Prior Updated Balance) * Last Different Growth Factor)

And should persist until there is a new value for Projected Funding Amount

So for example on

3/1 my Updated Principal should be

10,312,500.00 * (1 + (1,000,000/72,187,500.00)) = 10,455,357.14

and my Updated Balance should be 72,187,500 + 1,000,000 - 10,455,357.14 = 62,832,142.857

and my Growth Factor should be (1 + (1,000,000/72,187,500.00)) * 1 = 1.01385281

On each subsequent Date my Principal needs to be increased by the same Growth Factor until there is a new value for Projected Funding Amount

So on 4/1/ my Updated Principal should be 10,312,499.99 * 1.01385281 = 10,455,357.13

and my Updated Balance should be calculate using my prior Updated Balance and will be

62,382,142.857 - 10,455,357.13 = 52,276,785.72

then for 5/1 Updated Principal again is 10,312,499.99 * 1.01385281 = 10,455,357.13

and Updated Balance is

52,276,785.72 - 10,455,357.13 = 41,821,428.59

So far I have been able to achieve this in Qlik however where I am running into difficulties is when there is on 5/1 when there is a new value for Projected Funding Amount and my Growth Factor changes

On 6/1 my Growth Factor will be (1+(Projected Funding Amount/Prior Update Balance))* Last Different Growth Factor

(1+(2,000,000/ 41,821,428.59) ) * 1.01385281 = 1.06233766230987

my Updated Principal should be

10,312,500.01 * 1.06233766230987 = 10,955,357.15

and my Updated Balance should be

41,821,428.59 + 2,000,000 - 10,955,357.15 = 32,866,071.44

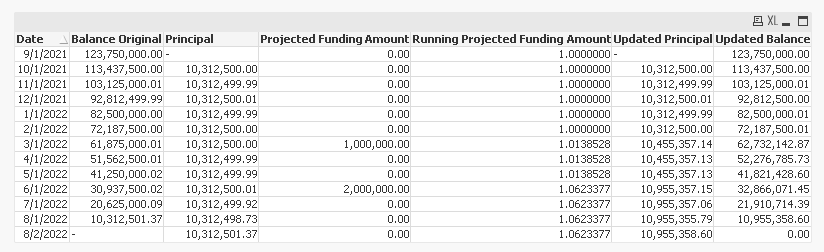

Ultimately my final table should look like this.

| Date | Balance Original | Principal | Projected Funding Amount | Growth Factor | Updated Principal | Updated Balance |

| 9/1/2021 12:00:00 AM | 123,750,000.00 | - | 0 | 1 | - | 123,750,000.00 |

| 10/1/2021 12:00:00 AM | 113,437,500.00 | 10,312,500.00 | 0 | 1 | 10,312,500.00 | 113,437,500.00 |

| 11/1/2021 12:00:00 AM | 103,125,000.01 | 10,312,499.99 | 0 | 1 | 10,312,499.99 | 103,125,000.01 |

| 12/1/2021 12:00:00 AM | 92,812,499.99 | 10,312,500.01 | 0 | 1 | 10,312,500.01 | 92,812,499.99 |

| 1/1/2022 12:00:00 AM | 82,500,000.00 | 10,312,499.99 | 0 | 1 | 10,312,499.99 | 82,500,000.00 |

| 2/1/2022 12:00:00 AM | 72,187,500.00 | 10,312,500.00 | 0 | 1 | 10,312,500.00 | 72,187,500.00 |

| 3/1/2022 12:00:00 AM | 61,875,000.01 | 10,312,500.00 | 1,000,000.00 | 1.013852814 | 10,455,357.14 | 62,732,142.86 |

| 4/1/2022 12:00:00 AM | 51,562,500.01 | 10,312,499.99 | 0 | 1.013852814 | 10,455,357.14 | 52,276,785.73 |

| 5/1/2022 12:00:00 AM | 41,250,000.02 | 10,312,499.99 | 0 | 1.013852814 | 10,455,357.13 | 41,821,428.59 |

| 6/1/2022 12:00:00 AM | 30,937,500.02 | 10,312,500.01 | 2,000,000.00 | 1.062337662 | 10,955,357.15 | 32,866,071.44 |

| 7/1/2022 12:00:00 AM | 20,625,000.09 | 10,312,499.92 | 0 | 1.062337662 | 10,955,357.06 | 21,910,714.38 |

| 8/1/2022 12:00:00 AM | 10,312,501.37 | 10,312,498.73 | 0 | 1.062337662 | 10,955,355.79 | 10,955,358.59 |

| 8/2/2022 12:00:00 AM | - | 10,312,501.37 | 0 | 1.062337662 | 10,955,358.59 | 0.00 |

Apologies if I did not explain well any help is very much appreciated.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Try this

SET NullInterpret = '';

Table:

LOAD * INLINE [

Date, Balance Original, Principal, Projected Funding Amount

9/1/2021, 123750000.00, , 0.00

10/1/2021, 113437500.00, 10312500.00, 0.00

11/1/2021, 103125000.01, 10312499.99, 0.00

12/1/2021, 92812499.99, 10312500.01, 0.00

1/1/2022, 82500000.00, 10312499.99, 0.00

2/1/2022, 72187500.00, 10312500.00, 0.00

3/1/2022, 61875000.01, 10312500.00, 1000000.00

4/1/2022, 51562500.01, 10312499.99, 0.00

5/1/2022, 41250000.02, 10312499.99, 0.00

6/1/2022, 30937500.02, 10312500.01, 2000000.00

7/1/2022, 20625000.09, 10312499.92, 0.00

8/1/2022, 10312501.37, 10312498.73, 0.00

8/2/2022, , 10312501.37, 0.00

];

Table1:

LOAD Date,

[Balance Original],

Principal,

[Projected Funding Amount],

If(Len(Trim(Peek('Running Projected Funding Amount'))) = 0, 1,

If([Projected Funding Amount] = 0, Peek('Running Projected Funding Amount'), (1 + ([Projected Funding Amount]/Peek('Updated Balance')))*Peek('Running Projected Funding Amount'))) as [Running Projected Funding Amount],

Principal *

If(Len(Trim(Peek('Running Projected Funding Amount'))) = 0, 1,

If([Projected Funding Amount] = 0, Peek('Running Projected Funding Amount'), (1 + ([Projected Funding Amount]/Peek('Updated Balance')))*Peek('Running Projected Funding Amount'))) as [Updated Principal],

RangeSum(Alt(Peek('Updated Balance'), [Balance Original]), [Projected Funding Amount],

-(Principal *

If(Len(Trim(Peek('Running Projected Funding Amount'))) = 0, 1,

If([Projected Funding Amount] = 0, Peek('Running Projected Funding Amount'), (1 + ([Projected Funding Amount]/Peek('Updated Balance')))*Peek('Running Projected Funding Amount'))))) as [Updated Balance]

Resident Table

Order By Date;

DROP Table Table;

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Works perfectly ! Thanks so much