Unlock a world of possibilities! Login now and discover the exclusive benefits awaiting you.

- Qlik Community

- :

- Support

- :

- Support

- :

- Knowledge

- :

- Member Articles

- :

- Bollinger Bands

- Edit Document

- Move Document

- Delete Document

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

Bollinger Bands

- Move Document

- Delete Document and Replies

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Bollinger Bands

Sep 25, 2024 2:23:26 PM

Mar 5, 2016 11:57:26 AM

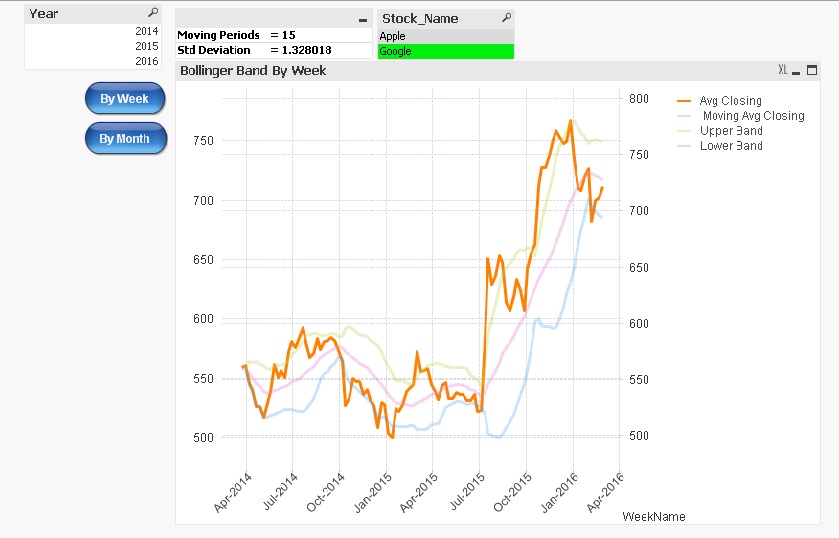

This article provides an overview of Bollinger Bands.

Many traders use Bollinger Bands to determine overbought and oversold levels, selling when price touches the upper Bollinger Band and buying when it hits the lower Bollinger Band.

Components of Bollinger Bands

1) Avg Stock Price

It's simple Avg of stock price.

2) Moving Avg of Stock Price

It's Moving Avg of Stock price over last n Period

3) Upper Band

Moving Avg of Stock Price + Std Deviation over last n Period * Std Deviation Multiplier

4) Lower Band

Moving Avg of Stock Price - Std Deviation over last n Period * Std Deviation Multiplier

Note :

-

Users can select their own moving period and standard deviation multiplier.

-

When viewing the Bollinger Bands on a weekly basis, users can choose a moving period ranging from 1 to 50.

-

When viewing the Bollinger Bands on a monthly basis, users can select a moving period ranging from 1 to 10.

-

The standard deviation multiplier can be inputted from 0.01 to 4.

Please refer to the attached application.

Additionally, please see:

- Move Comment

- Delete Comment

- Mark as Read

- Mark as New

- Bookmark

- Permalink

- Report Inappropriate Content

Kushal Sir thanks for this.

- Move Comment

- Delete Comment

- Mark as Read

- Mark as New

- Bookmark

- Permalink

- Report Inappropriate Content

useful information

- Move Comment

- Delete Comment

- Mark as Read

- Mark as New

- Bookmark

- Permalink

- Report Inappropriate Content

Excellent! Very interesting and useful.

Will try

- « Previous

-

- 1

- 2

- Next »